But fear not! We’re here to unearth the myth around these financial instruments and help you understand them better. In short, bridge loans are interim financing tools. They give you some extra room while transitioning, for instance, between buying a new house and selling your current one.

On the other hand, hard money loans are nothing more than short-term bridging. Many real estate investors choose these arrangements to manage multiple flip ventures, and they depend on the value of collateral rather than credit scores.

Which one you’ll choose is a matter of your standing, needs, and capabilities. When thinking of bridge vs hard money options, each has both good and bad aspects, so you have to understand and weigh them before making a final decision.

Bridge Loan: Definition and Concepts

As its name says, this financial arrangement acts as the bridge that connects two major financial statuses from one substantial financial transaction to another. Here’s one appropriate situation: you’re about to move to your new property but still haven’t sold your existing one. That’s where a bridge loan kicks in. You can use it to overcome the financial gap until you secure long-term financing or sell your existing property.

The short-term nature of these arrangements usually means the terms go from a few weeks to a few months. On the other hand, permanent financing has tenure as long as five, ten, or more years. So it’s a temporary solution with a high priority to provide you with cash to move from one situation to another smoothly.

One of the key benefits that bridging arrangements provide is a high degree of flexibility. They can be used for other things than housing, like commercial property investments or starting a business. Either way, it can be a good deal, but you still have to consider the pros and cons of this borrowing option. These deals can sometimes be costly and come with strict eligibility criteria.

What About Hard Money Loans

Hard money loans are exceptional among borrowing deals. They offer a unique way of funding, especially for real estate investors. Unlike conventional arrangements, which usually focus on your credit rating and financial standing, hard money loans prioritize property value. Simply put, that will be your collateral.

Why lenders need collateral, find out on the following source:

https://www.cnbc.com/select/what-is-collateral/

As said, these deals usually target investors or property developers who may not fall under the strict requirements of conventional lenders. They appeal because of their accessibility and fast approval process. If you haunt time-sensitive offers, this is your deal.

But unlike other secured arrangements, these come with a higher interest rate, significant borrowing costs, and shorter repayment periods. Still, one thing is the same: the lender will repossess collateral if you fail to make repayment.

Despite the rigid eligibility criteria, flexibility makes hard money loans available even to borrowers with poor scores or unconventional income sources. But as with any financial decision, you must conduct thorough research and take time for evaluation to borrow money this way.

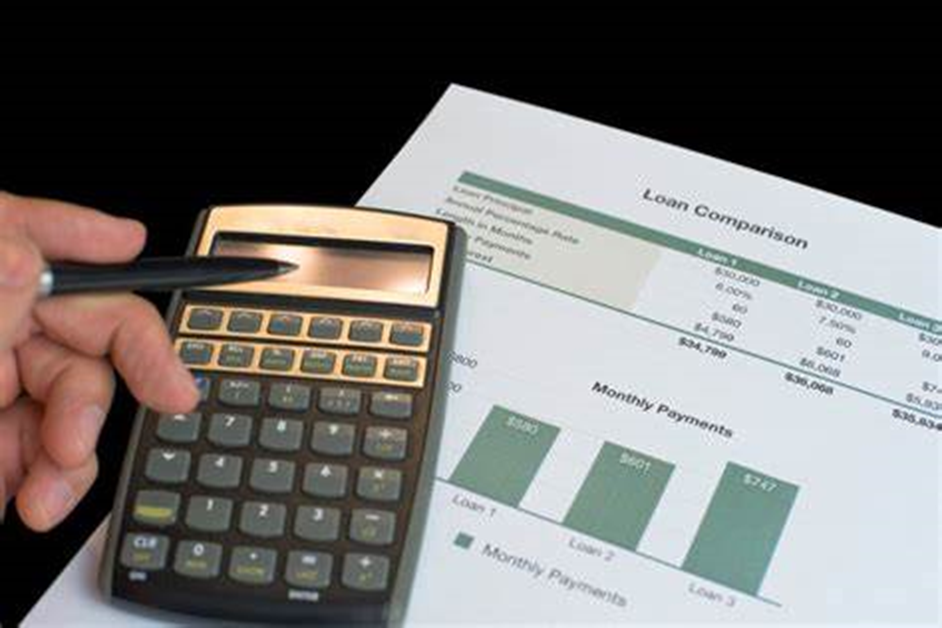

Apple-to-Apple Comparison

If you plan to borrow money and these two suggested arrangements seem like a good fit, you must know how to discern their disparities. That’s critical to making wise financial decisions. On the one hand, both bridge and hard money loans are short-term borrowings, but on the other, they have their ins and outs. Here, learn about the benefits of short-term lending.

The purpose of bridge loans is to help with situations where two major transactions take place in one go. They come with shorter repayments but can be approved fast, so they are handy when you need cash immediately. On the other hand, these arrangements come with a higher price tag, and the borrowers’ eligibility is also more stringent.

Hard money arrangements also have fast approval and can be costlier than “regular” secured arrangements. However, they differ from bridge loans by prioritizing collateral value over the borrower’s creditworthiness and being available even to those with not-so-great credit histories.

Bridging vs. hard money loans is a question of checking your financial situation, lending terms, and risk-taking ability. Once you consider both the benefits and disadvantages of your choices, you can decide which borrowing method suits you best.

Application Procedures and Eligibility Requirements

Every borrowing comes with more or less the same application procedure. Lenders have the freedom to determine lending criteria and terms. In the case of bridge and hard money loans, you must grasp the processes and requirements so that the application runs smoothly.

The eligibility criteria vary for various types of borrowing. Bridge loans usually consider the borrowers’ income, good credit scores, and existing property, but you don’t need any guarantee for repayment. Hard money focuses on the value and condition of the collateral.

As for the bridge loans, start by gathering the necessary papers like income proof, credit reports, and property information. Search for reliable lenders specializing in these financial products and submit your application and documents. Lenders will review your financials and property details and make a decision.

On the other hand, hard money lending involves getting security for this arrangement. You can research lenders specializing in these deals and submit your application with the collateral’s value instead of your credit history. It will take a while for a lender to do due diligence on your collateral to confirm its value and accessibility. Upon approval, you can finalize the terms and get money on short notice.

If you’re trying to figure out if a bridge loan or a hard money loan is better for you, you simply must understand your borrowing needs and the purpose of these deals. Only then can you evaluate their pros and cons and make choices that’ll work out for you and align with your goals.