Meta’s anti-fraud systems are rigorous, so not just any card is suitable for paying for ads on Facebook. Frequent card usage means the system starts to “remember” the card and becomes stricter. Sometimes, even standard media-buying actions appear suspicious, leading to account restrictions or even blocks. For Facebook Ads, virtual cards are often the easiest and most cost-effective solution. However, there are a few essential rules when choosing one.

Meta’s anti-fraud systems are rigorous, so not just any card is suitable for paying for ads on Facebook. Frequent card usage means the system starts to “remember” the card and becomes stricter. Sometimes, even standard media-buying actions appear suspicious, leading to account restrictions or even blocks. For Facebook Ads, virtual cards are often the easiest and most cost-effective solution. However, there are a few essential rules when choosing one.

It’s generally recommended to use virtual cards with BINs (Bank Identification Numbers) from banks in the UK, US, or Europe. Cards should be compatible with Visa or Mastercard networks and support payments in USD or EUR. Failing to meet these criteria may lead Facebook to decline payments. In this article, we’ve reviewed a virtual card for Facebook Ads from PSTNET, which can help reduce declines since they’re credit cards. Meta’s systems often favour credit cards because they offer a reliable spending limit for ad payments.

Cards for Facebook Ads: Key Features and Advantages

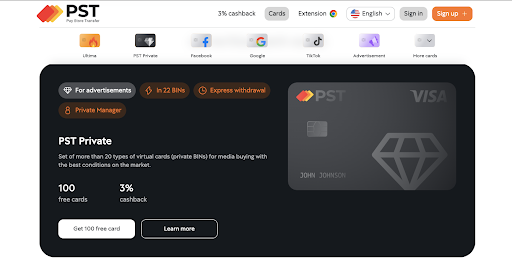

PSTNET provides virtual cards designed specifically for all major ad platforms, including dedicated debit cards for Facebook Ads and credit cards with premium BINs. All cards from PSTNET work with Visa and Mastercard.

The cards are issued by banks in Europe and the US and come with over 25 trust-rated BINs, reducing the chances of encountering “risk payments.” There are no transaction fees, no charges for withdrawing funds, and no fees for handling blocked cards. Moreover, the cards can be issued in unlimited quantities.

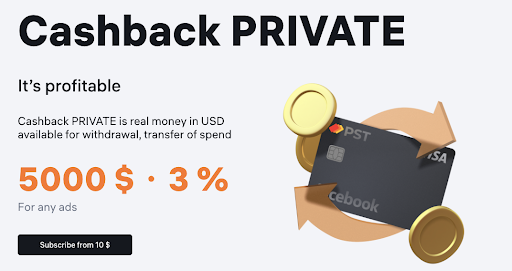

For media buyers, PSTNET also offers an exclusive programme called PST Private. Through this programme, users can issue up to 100 cards per month at no cost. It also includes a 3% loading fee and a 3% cashback on ad expenses, potentially saving up to $3,000. Cashback is automatically credited to the cards used for payments, with no need for ad spending verification — just choose a suitable plan on the website. Plans include Large, Medium, Small, and Extra Small packages.

Users also gain access to finance management tools in their personal accounts. These allow for adding team members, assigning roles, and setting card limits. Detailed financial reports are available for all transactions, helping users keep track of expenses.

Additionally, PSTNET provides a BIN checker tool called Pulse. This tool not only identifies the card type and issuing country but also provides insight into billing limits, average monthly spend, and approval/decline rates.

Technical Specifications of the Cards:

- 18 cryptocurrencies available for card loading

- Card funding via SWIFT/SEPA transfers and Visa/Mastercard

- 3D Secure Technology

- Two-factor authentication

- Instant card activation upon registration

- Registration process completed in just one minute

Registration and Card Issuance

You can sign up with your email or log in with Google, Telegram, or Apple ID accounts. Once signed up, you’ll have access to your personal dashboard, where you can choose your preferred card for ad payments or join the PST Private programme. For bulk card issuance or balances exceeding $500, a quick verification process is required for security, usually taking less than an hour.

- Customer Support: Support is available instantly through Telegram, WhatsApp, or live chat, while a multifunctional Telegram bot provides service notifications and 3DS codes.

Conclusion

Virtual cards make paying for Facebook Ads easier and more cost-effective. With PSTNET’s 3% cashback and zero fees, each dollar invested goes further.

Choosing the right card for ad payments can not only reduce ad costs but also streamline business processes. Team collaboration features and expense analytics help optimise work, saving both time and resources.